|

How Credit Controls Your World by Ordinary Things

At first glance this article may look brief, however; this knowledge is extensive and could drastically change your life. When researching this i imagined what my life would be like if i had learned this at 16 years old! What you are about to see is only the Tip of the proverbial Iceberg!

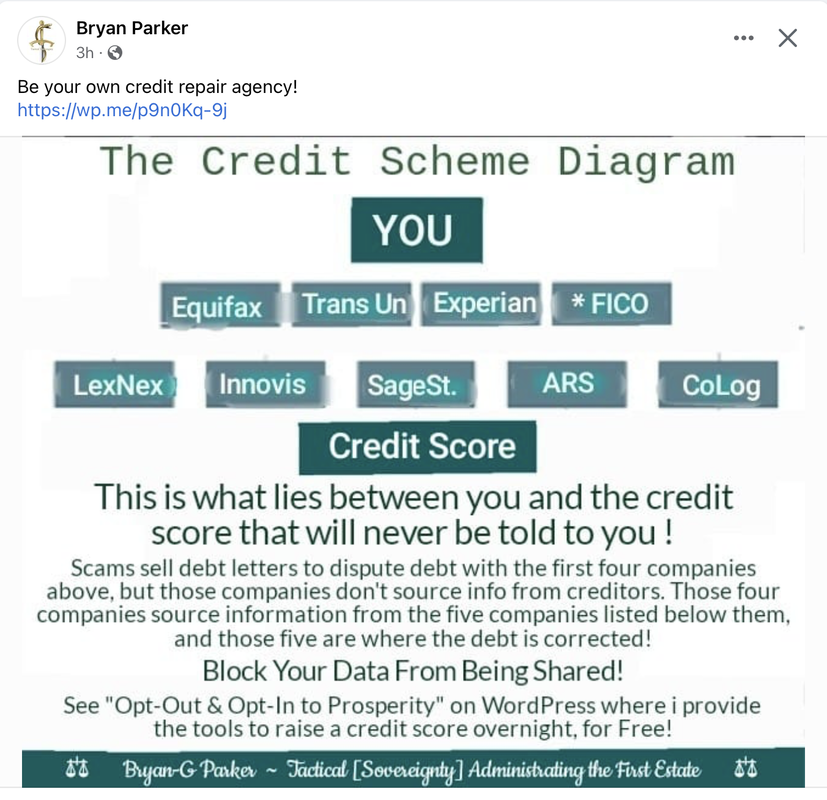

Before exploring the following tools i’ve provided to resolve credit issues watch this short 2 part playlist to comprehend how this system operates. This same playlist is also available at the end of this article. Before trying to freeze your credit by submitting crazy online dispute letters known as 609’s to TransUnion, Equifax, Experian and FICO go to their sources and Opt-out of their services. These are 5 lower tier Middle-men, and it’s bigger than the credit score, it’s about you data and Personally Identifiable Information, PII. When a dispute letter goes to a reporting agency it’s not read by a man or woman, it’s read by a computer program named E-OSCAR, and Oscar doesn’t care about your fancy words or Case Law, just the basic facts, and produces a rating between 26-30 for the legitimacy of your claim, and yes, Oscar can be a grouch! This is the order of contact a typical 609 credit dispute follows. Dispute>Reporting Agency>E-OSCAR>Lender It is also good to contact agencies in writing, but follow these 2 details:

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/consumer-reporting-companies/companies-list/lexis-nexis-risk-solutions/

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/consumer-reporting-companies/companies-list/innovis/

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/consumer-reporting-companies/companies-list/sage-stream/

https://www.preventloanscams.org/dealing-with-ars-collections/

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/consumer-reporting-companies/companies-list/core-logic-credco/ There’s another company separate from the big 3 FICO (Fair Issac Company) who provides a more general score and according to them this what they do. “In the course of our business activities, we collect, process, store, and disclose personally identifiable information” If desired you can learn more at the link below, but turn on your legal mind while reading! https://www.myfico.com/policy/privacy-policy/ Below is a link for OptOutPreScreen and this company is where i ended up to Opt-Out of FICO. This is also who does a “Soft Pull” on your credit and is responsible for all that “Junk mail” we receive that offers us all those great deals we just can’t refuse, no thank-you! Opt-Out Prescreen: https://www.consumer.ftc.gov/articles/prescreened-credit-and-insurance-offers As a bonus gift to everyone here, are you tired of Telemarketer and Robo calls? The National Do Not Call Registry was created to stop unwanted sales calls. It’s free to register your home or cell phone number. Go to donotcall.gov or call 1-888-382-1222 from the phone you want to register. It can take up to 31 days for sales calls to stop. After which time we need to realize that fines can be applied to companies that don’t respect your desire to not be contacted! Check it out, there’s people that make a lot of money by collecting on those calls! Keep in mind what your options are and know what you want to accomplish. You can opt-out from those give (5) lower level companies to prevent negative reports and sit back waiting for these to drop off, or time out, but you can also be proactive and dispute directly with those companies. Those disputes should be a simple one page letter containing 1. YOUR NAME 2. ACCOUNT NUMBER 3. THE REASON WHY THE REPORT IS INCORRECT Keep in mind also, and most people don’t know this, a Universal Default can change any agreements you have with other companies! What’s a Universal Default? This can occur if you have a late payment with company A, then companies B,C,D and E see that late payment and decide you could be high risk now and change your agreements with them. Such actions can raise your 8% interest rate with them to 23%, not good! Remember, any and all of your activities are your intangible property, protect your property, because no one else will! OPTION #2 No need to Opt-Out? What if you aren’t concerned with Opting Out to prevent bad or false data from being provided to companies you choose to contract with and your real need is to build a favorable credit profile, it could be more easy than you think! Did you know that you can be your own bank, generate a loan to yourself, pay it off, and boost your credit score? One place where this can be done is at Self Inc. SELF INC. https://www.self.inc/ Here’s another option, Nerd Wallet. Build your credit profile with the activities you already perform on a daily basis! NERD WALLET https://www.nerdwallet.com/article/finance/rent-reporting-services What services can a company like Nerd Wallet provide? How many expenses do you have every month that don’t help your credit? There are multiple other companies services you can use independently. Note that your landlord may need to verify your rent payments. Some services may not be able to report your payments if your landlord doesn’t verify, but landlords do report if you are found negligent, so what options are available to you? Here are some services shown by Nerd Wallet that will report your positive rent & utility activity, and not from just day one of enrollment but they can backdate the activity 24 months prior! Rent Reporters: There is a one-time enrollment fee of $94.95, which includes up to two years of reported rental payments, then the service is $9.95 per month. It reports to TransUnion and Equifax. Rental Kharma: Initial setup is $50, including six months of past history, and the service is $8.95 per month. It reports to TransUnion. LevelCredit: Previously known as RentTrack, LevelCredit charges a $6.95 monthly fee to have your rent and utility payments reported to Equifax and TransUnion. A look-back of up to 24 months is available on your current lease for a fee. Rock the Score: There is an enrollment fee of $48, and ongoing service costs $6.95 per month. There is a $65 fee for reporting up to two years of rental history. It reports to TransUnion and, if the landlord is a property manager, Equifax. Esusu Rent reports your rental payments to the three major credit bureaus. You can sign up as an independent renter for a $50 annual fee on the Esusu Rent mobile app. (It also has a version offered through landlords.) CreditMyRent: This service charges a monthly fee of $14.95 with no setup fee. There are additional charges if you want past rent reported. It reports to TransUnion and Equifax. PaymentReport: A $49 enrollment fee gets you two years of rental history reported to Equifax and TransUnion. Ongoing reporting is free. (It also has a version offered through landlords that requires electronic rent payments.) Services you can use if your landlord does ClearNow: This service debits your rent from your checking or savings account. There’s no cost to tenants, but your landlord must be signed up. If you opt in, payments are reported to Experian via its RentBureau. PayYourRent: Fees are typically paid by management. It reports to all three credit bureaus. These were just a few services available to build a credit score with little or no new financial activity on your part, but what if you want to exist in anonymity and be in the Private? A program exists that is approved by the FBI, the Federal Bureau of Investigation, but isn’t really liked by many establishments, it’s called the CPN. The Credit Profile Number, also known as the Credit Privacy Number, is a number separate from the Social Security Number that can be used in contracting with companies, however this 9-digit number can not be masqueraded as a SSN! There are only 2 recommended methods of acquiring the CPN. First you can go to an attorney who provides this service, and probably pay heavily for this. Secondly you can visit a Social Security office in person, which is much more economical! When researching the CPN you will find countless articles that quote “The illegal use of a CPN”! These are meant to prevent you from using a CPN with what i call Word Magic. Anything can be used illegally, but it doesn’t make it’s use illegal, see the difference? Hopefully you can “Read between the Lines” in the knowledge provided above. The Coin of the Realm isn’t just Federal Reserve Notes (FRN/USD) it’s really Credit, and more specifically Credit Data. This data is all about you, your habits, your spending patterns, your employment history and relationship with the Justice System. These all paint a picture about whether or not you are a potential liability. Secondly, this is a perfect tool for not only tracking your behavior, but also in locating you. Lastly, we need to learn how to grow our wealth, and wealth isn’t just gold, silver, or even that Monopoly Money you get paid in, today’s wealth is Credit! Please don’t confuse this with Debt, debt is the currency of the sinner! Enjoy your path to prosperity! Here is a short 2 part playlist on credit repair which i highly recommend watching to comprehend the information i’ve provided above, all of which is 100% legal to do, but please don’t use this knowledge dishonorably.

How To REMOVE Hard Inquiries From Credit Report For FREE! by Naam Wynn

HARD PULL (Stay on your credit report for 2 years)

How to remove hard pulls off your credit report

List of consumer reporting companies

Experion (Freeze credit: 888-397-3742)

Equifax (Freeze credit: 888-378-4329)

TransUnion (Freeze credit: 833-395-6938)

0 Comments

|

News Stories

All

Archives

January 2030

|

RSS Feed

RSS Feed